Escalando Soluções Baseadas na Natureza (SBN) no Brasil

O Nature Investment Lab (NIL) é um laboratório criado para atrair e dimensionar investimentos em Soluções Baseadas na Natureza (NBS).

Reúne o setor privado, as finanças, o governo e a sociedade civil para impulsionar investimentos e ações climáticas impactantes na agricultura regenerativa, na restauração florestal e na bioeconomia.

A NIL foi fundada pelo Banco do Brasil, BNDES, GFANZ, iCS e Instituto Itaúsa, tendo como secretaria executiva a Climate Ventures.

Este laboratório serve como sua porta de entrada para descobrir, apoiar e dimensionar soluções positivas para a natureza que beneficiem as pessoas e o planeta.

Nosso objetivo é preencher a lacuna entre investimentos financeiros, conservação e restauração da natureza — promovendo colaboração, inovação e projetos viáveis. Trabalhamos ao lado de diversas partes interessadas — investidores, decisores políticos, comunidades e inovadores — para promover coletivamente a transição para uma economia mais sustentável, resiliente e de baixo carbono.

Últimas notícias

Contrato de off take de carbono

Versão de base para fortalecer e padronizar as transações de crédito de carbono no Brasil.

Programa de Assessoria para Financiamento de Negócios Regenerativos

Projeto e lições aprendidas para o ecossistema

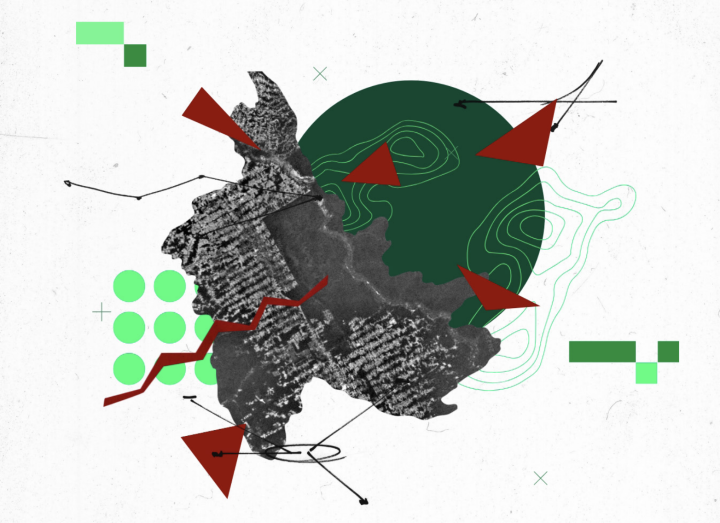

Resumo de Política RPPN: Motores da Conservação da Biodiversidade, Serviços Ecossistêmicos e Sumidouros de Carbono | Nature Investment Lab

Identifica desafios financeiros e jurídicos que limitam a sua expansão e propõe incentivos mais fortes, financiamento climático e melhorias na governança